how to calculate cogs

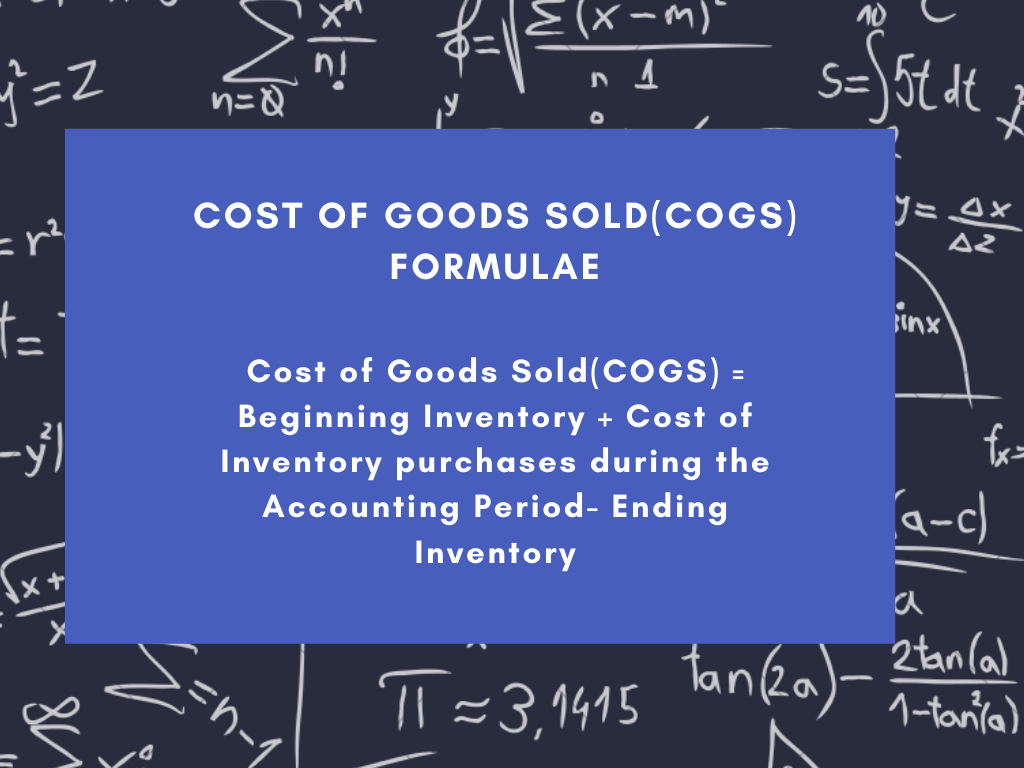

Beginning Inventory Purchase - Ending Inventory. If you do you have inventory costs youll use the traditional.

|

| How To Calculate Cost Of Goods Sold Cogs |

COGS Cost of goods manufactured Opening finished goods inventory Ending finished goods inventory.

. Finally subtract the inventory you didnt sell at the end of that accounting period. Add that to the cost of what you purchased during that period. To calculate COGS businesses need to consider all the direct costs associated with a product or service. They ended February with 500 worth of food inventory.

COGS Opening Stock Purchases Closing Stock. To calculate the COGS for manufactured goods. COGS 5000 500. In the above example the weighted average per unit is 25 4 625.

Cost of Goods Sold - COGS. COGS is essentially how much it costs you to produce your products or services. Calculate COGS by adding the cost of inventory at the beginning of the year to purchases made throughout the year. At Henry Herbert the process of calculating COGS starts by taking the cost of current.

This amount includes the cost. The cost of goods sold is the wholesale price of a product or material to a distributer retailer or. Instead it focuses on the value of inventory at the. With that said the COGS in Year 1 can be calculated with the following simple formula.

Thus for the three units. COGS stands for cost of goods sold. COGS 20000 8000 - 6000 COGS 22000. Cost of Goods Sold Beginning Inventory Value - Ending Inventory Value Total Inventory.

Heres an example to further. COGS 50000 500000 20000. Lets build the cost of goods sold calculator in Excel. You will notice that the cost-of-goods-sold formula makes no reference to the number of sales.

The higher a companys COGS the lower its gross profit. Why retailers use this COGS formula. Gross Profit and Gross Margin Calculation. If you dont have any inventory costs to consider then the figure you calculated in step one is your COGS for services.

To calculate COGS in Excel first you need. How to calculate the cost of goods sold. Cost of goods sold COGS is the direct costs attributable to the production of the goods sold in a company. Gross profit is obtained by subtracting COGS from revenue while gross margin is gross profit divided by revenue.

This is multiplied by the actual number of goods sold to find the cost of goods sold. Thus from the above example it can be observed that the cost of. So we have all the pieces in place. Johnnys Burger Bars COGS for the month of.

In this lesson you can learn how to calculate COGS in Excel. Lets calculate COGS using the formula above. Heres how calculating the cost of goods sold would work in this simple example. COGS 25m 10m 5m 30m.

Now lets us apply the COGS formula and see the results. COGS 3000 2000 500. COGS is a simple accounting principle that measures the input costs your business incurs when manufacturing products or services and helps determine your gross profit and margins.

|

| How Do I Calculate Cogs In My Amazon Business |

|

| How To Do Cogs Calculation For Manufacturers |

|

| Cost Of Goods Sold Definition Formula Calculate Cogs |

|

| What Is Cogs Website Rating |

|

| Cost Of Goods Sold Formula Calculator Excel Template |

Posting Komentar untuk "how to calculate cogs"